Our Investment Criteria

Every deal we offer our investors has to pass through four key metrics to align with our investment philosophy. Your interests, our mandate.

-

Asset-Backed Investments

We target investments where cash flow is backed by hard assets with intrinsic value. This strategy mitigates risk, accelerating returns to the investor during the time we hold the asset.

-

Near-Term Cash Flow

We focus on yield-producing assets which pay out periodic distributions throughout the investment lifecycle. Our goal is near-term cash yield combined with a strong IRR upon sale or refinance.

-

Proven Management Teams

Our operating partners are successful, knowledgeable and highly specialized in their respective areas of expertise. We work with partners with proven track records, delivering strong results.

-

Clear Exit Strategy

We select assets which have a readily available secondary market. Our strategy offers more flexibility to identify the right time to exit each investment, providing better returns to investors.

Target Acquisition Strategy

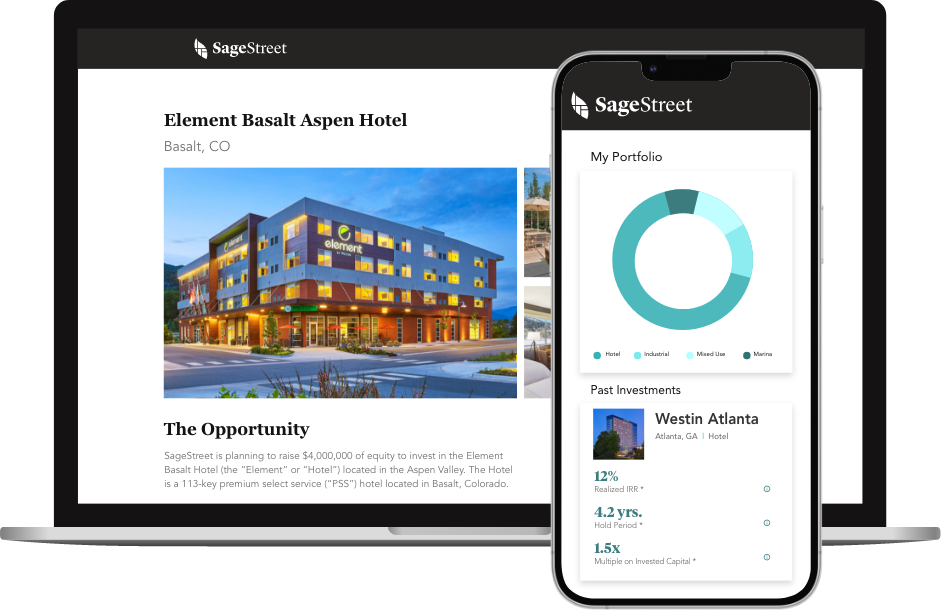

We enable our investors to create a diversified portfolio of yield-producing assets.

Asset value ranges that are too big for most individuals and too small for institutions.

Target leverage ratio at which our operating partners look to acquire an asset or portfolio of assets.

Total equity available is based on the purchase price and leverage ratio.

Geographic Diversification

We are hyper-focused on investments in front of the path of economic growth in major US metros.

We analyze macroeconomic, population and employment trends, identifying those markets offering high-yield, high-quality opportunities for our investors.

Industry Diversification

Different asset classes perform differently across markets and economic cycles. At SageStreet, we perform deep research to identify opportunities across industries.

Our goal is to help our investors mitigate risk and protect their portfolios with a variety of industry options.

Operator Diversification

We work with best-in-class operating partners — experts in their respective asset categories with proven track records.

Our relationships with experienced and successful operators allow SageStreet to offer investments that otherwise would be out of reach to individual investors.

See what it means to work with a team that values your future.

How we are different.

We target asset-backed investments to deliver strong near-term cash flow and solid returns.

Simple, understandable and transparent. We provide dedicated service to our investors.

Growth markets with strong population trends, increasing household income and positive economic indicators.

Trusted, highly specialized operating partners, each with deep expertise in their asset category.

Best-in-class always — the most exclusive opportunities.

SageStreet evaluates hundreds of deals a year. We execute a rigorous underwriting process on each investment, which includes an extensive review of both the operating partners and assets in order to determine the best opportunities for our investors.

Diversified portfolios — less risk , less volatility.

During times of inflation, equity on real estate typically increases. Diversifying your portfolio with private equity and real estate can help protect you from volatility and risk because performance isn’t tied to the stock market.

We offer you the ability to diversify like an institution, giving you the power to invest in what fits your risk and return profile best.

Institutional quality — asset-backed for long-term growth.

We focus on investments for which the cash flow stream is backed by a hard asset that always has intrinsic value. This mitigates risk by accelerating a portion of the return to the investor during the time we hold the asset. Institutional investors have had access to these types of assets for years, now you do too.

Passive income — real assets, real returns.

Real cash returns both from quarterly distributions and the sale of the asset.

We enable our investors to create a diversified portfolio of yield-producing assets without the active management and stress associated with owning private equity and real estate directly.

Create your financial legacy.

Our best-in-class investment platform brings targeted investment deals to our accredited investor community, providing you the freedom to build the future you imagine.

Our dedicated team is with you through the entire process. Any question, any time.

Get Started