At a Glance —

- The commercial real estate (CRE) market can offer the potential for lucrative investments, especially in times of market volatility and disruption

- Securing CRE properties at attractive pricing is ever more possible during a declining or recessionary market — buy low, sell high

- Other benefits include ongoing attractive yields, long-term value growth along with both diversification benefits and inflationary protection which are incredibly important in a volatile market

Commercial real estate (CRE) opportunities provide numerous important benefits for investors. We’ve written previously about those benefits. While CRE has always been a valuable option for investors, times of volatility and disruption can actually present new and even more lucrative opportunities. There are a number of reasons for this.

Attractive yields and long-term growth.

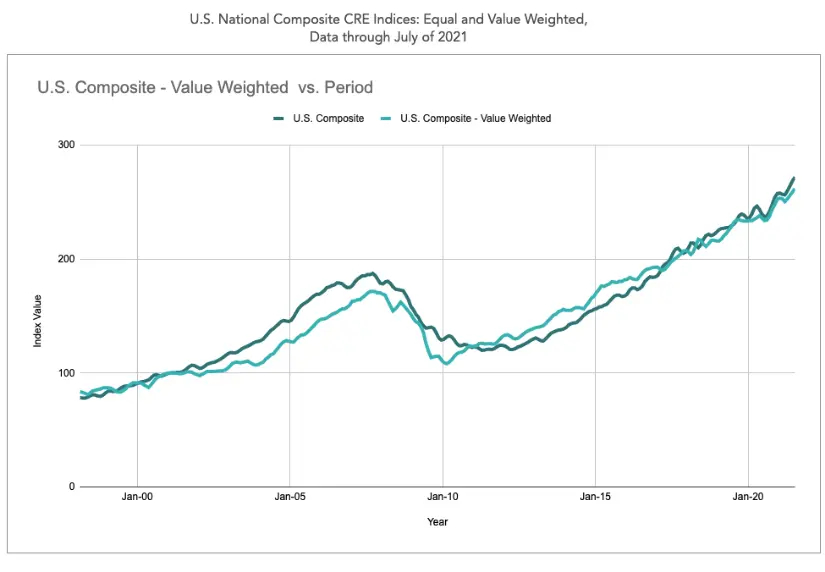

CRE will continue to offer attractive yields and potential for longer-term growth in almost every market circumstance. Consider this trend graphic depicting CoStar’s National Composite CRE Price Index from January, 1998 to July, 2021. Their index uses a methodology that measures movement in the prices of national, investment grade commercial properties by collecting data on actual transaction prices. While the index reflects a period of value/price decline stemming from the last recession (‘08/’09), we also see those values recover and escalate.

During the current market disruption, select asset-class sectors have experienced declines in occupancy rates and rental incomes. Whereas others, such as industrial and logistics, remain incredibly resilient and have even seen an increase in demand due to the rise of e-commerce. Investors who are able to identify and target the right sectors and asset classes will benefit from attractive yields and potential for growth.

Learn more about CRE asset classes.

The potential for forward looking price reductions.

Market disruptions, in general, help create opportunities for investors to acquire assets at more attractive prices. During times of uncertainty, some investors become more risk-averse and may look to divest their assets, creating opportunities for other investors to acquire those assets at discounted prices. Buy low, sell high.

Diversification

Diversification across investments is the planned variation across multiple investments, asset classes and industry sectors. This represents a mainstay strategy to minimize investment risk. When the market is volatile, an overall investment diversification strategy — which also includes CRE and other alternative investments — can help further increase the potential that select investments will perform well when others may not.

Read more about the importance of diversification.

Inflation Insulation

Commercial real estate is a tangible asset — land and buildings — which provides investors with the benefit of holding real assets. CRE property values typically appreciate during times of inflation and, unlike stocks and bonds, commercial real estate is not directly correlated with the public market, providing insulation against inflation — an important strategy when the market is shaky.

Read more about CRE as a powerful hedge against inflation.

CRE Analytics Advancement

Finally, while not tied directly to the current market conditions, continuing advancements in technology and data analytics are providing investors with new tools to evaluate and analyze commercial real estate investments. With access to real-time data, investors can make data-informed decisions to optimize their portfolios for maximum returns. Right place, right market, right time.

Despite the challenges brought about by the pandemic and following period of market volatility, commercial real estate continues to offer attractive investment opportunities through new and changing benefits.

Warren Buffet’s advice helps encourage investors to take a contrarian approach and avoid following the crowd. Market disruption generally allows investors to identify and acquire assets opportunistically. When some investors are fearful and sell, this creates opportunities for others who may be willing to take a contrarian approach to acquire those assets at discounted prices.

Bottom Line —

Consider taking a contrarian approach when faced with a volatile market. By using the data available, you can identify CRE investment opportunities which will best serve your long-term goals and objectives and importantly, protect and grow your wealth.

Invest in your future, today.

Are you an accredited investor ready to invest in commercial real estate?

Get Started