Investing Basics

Investors who identify and target select sectors and asset classes can benefit from strong yields and value growth during volatile market periods.

CRE investors should perform due diligence when evaluating investments; analysis which includes the review of target metrics provided by the operator.

CRE and alternative assets can be smart options to help balance your portfolio for retirement — providing stability, income and wealth protection.

There are four stages of the CRE investment lifecycle, each with important activities intended to optimize value and support a successful exit strategy.

There are a wide variety of CRE investment options. Find opportunities that are right for your portfolio, matching your risk profile, strategy and goals.

CRE investments can return several sources of income — capital appreciation, operating income and depreciation advantages. Plan for your investment.

Accredited investors have access to unregistered securities and alternative investment. Learn the criteria required to qualify as an accredited investor.

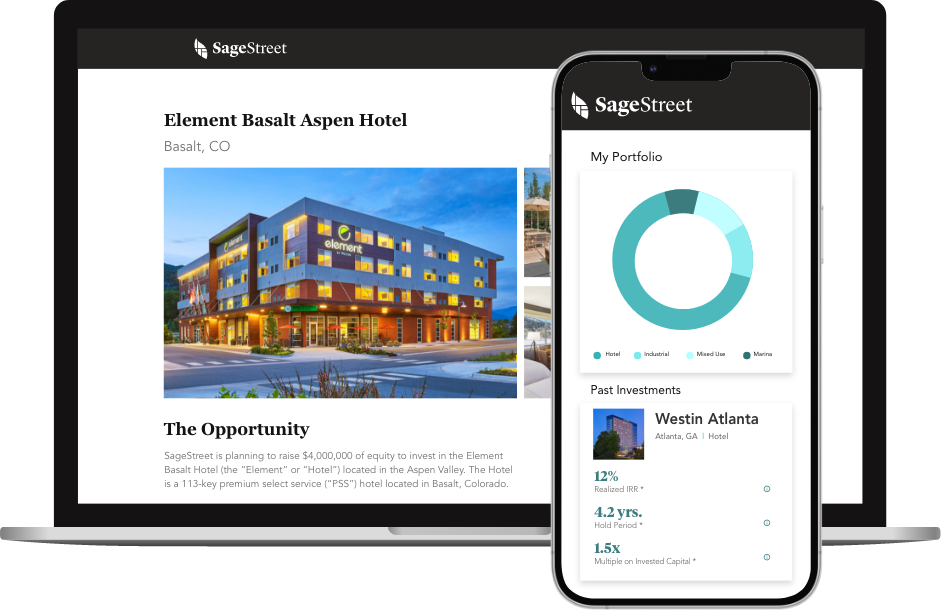

Invest across a variety of asset classes to mitigate risk without sacrificing opportunity. Form your diversification strategy to protect from volatility.

Support your investment strategy with a clear understanding of your investor profile matched with investment selections tailored to your objectives.

There are options to invest beyond the traditional market. Consider adding alternative investments to your portfolio — learn more about the benefits.

Create your financial legacy.

Our best-in-class investment platform brings targeted investment deals to our accredited investor community, providing you the freedom to build the future you imagine.

Our dedicated team is with you through the entire process. Any question, any time.

Get Started